Parkinson’s Association of San Diego

The mission of PASD is to enable those affected by Parkinson’s disease to live their best lives through support, resources, and education.

Please note our new phone number: 858-210-5674

THE GOOD START PROGRAM

Designed for newly diagnosed people with Parkinson’s and their care partners, but everyone who would like to update their knowledge base of PD are also more than welcome to attend.

The March 5, 2024 Good Start Program

Watch below to see the complete program.

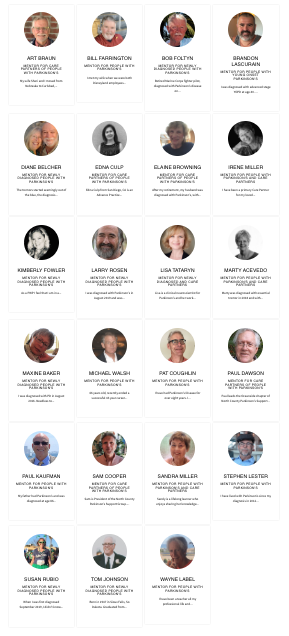

The March 5, 2024 Good Start Program featured Dr. Brenton Wright, Movement Disorders Neurologist and Medical Advisor to PASD; PASD Board President Marty Acevedo, RDN; Kristine Negrete, DPT; Irene Miller, Fallbrook Support Group Team Leader; and PASD Executive Director Chris Buscher.

LET’S PLAY SOME GOLF!

Annual Parkinson’s Association of San Diego Golf Tournament

Monday, June 10, 2024

Fairbanks Ranch Golf Course

15150 San Dieguito Rd, Rancho Santa Fe, CA 92067

This fundraising trek is the Kumano Kodo, one of only two “caminos,” or pilgrimages, that are world heritage sites. This trek, in the mountains south of Kyoto, is the sixth international trek led by Sherrie Gould and Victory Over Parkinson’s. Earlier trips were Kilimanjaro, Mt. Everest Base Camp, Machu Picchu, Camino de Santiago, and the Dolomites in Italy… [READ MORE]

An Education Program on Parkinson’s for Mental Health Professionals

We have created a comprehensive, 6-CE unit program to introduce clinical psychologists, marriage and family therapists, and social workers to the medical, psychological, and social intricacies involved with working with people with Parkinson’s.

Open your practice to a world of possiblilties!

Psychologists, MFTs, Social Workers:

WE NEED YOU!

San Diego’s movement disorder neurologists need many more mental health professionals for their patients.

“A powerful population to work with.”

“We’re so much more than caregiver and patient.”

“People really lose their former identity of who they were and everything they were able to do.”

THE PARKINSON’S ASSOCIATION OF SAN DIEGO MICROCAST SERIES

Are you living with Parkinson’s, or caring for someone with Parkinson’s?

Listen to our new, short podcasts from movement disorder specialists, physical therapists, nutritionists, and others.

Click on any episode to listen, or click the button below to listen on Apple Podcasts. And be sure to leave us a rating and review!

Events and Community

Upcoming Live and Virtual Events,

Opportunities and Offerings for the Parkinson’s Community

View the Page. Click Here.

EXERCISE OPPORTUNITIES

How to keep moving, online and in person

Care Partners –

The People with Angel Wings

In the journey with Parkinson’s, care partners are, in many ways, the most critical players. Giving endlessly to those they love, care partners are often overlooked when it comes to support.

Sponsored By:

Care Partner Education Program

We encourage you to use this content to help you stay educated, stay strong, stay healthy, and always to strive to find the positive in everything.

Tribute Wall

This is a special place where we honor, remember, and celebrate the lives touched by Parkinson’s disease.

If you’d like to make a Tribute to someone, please click here:

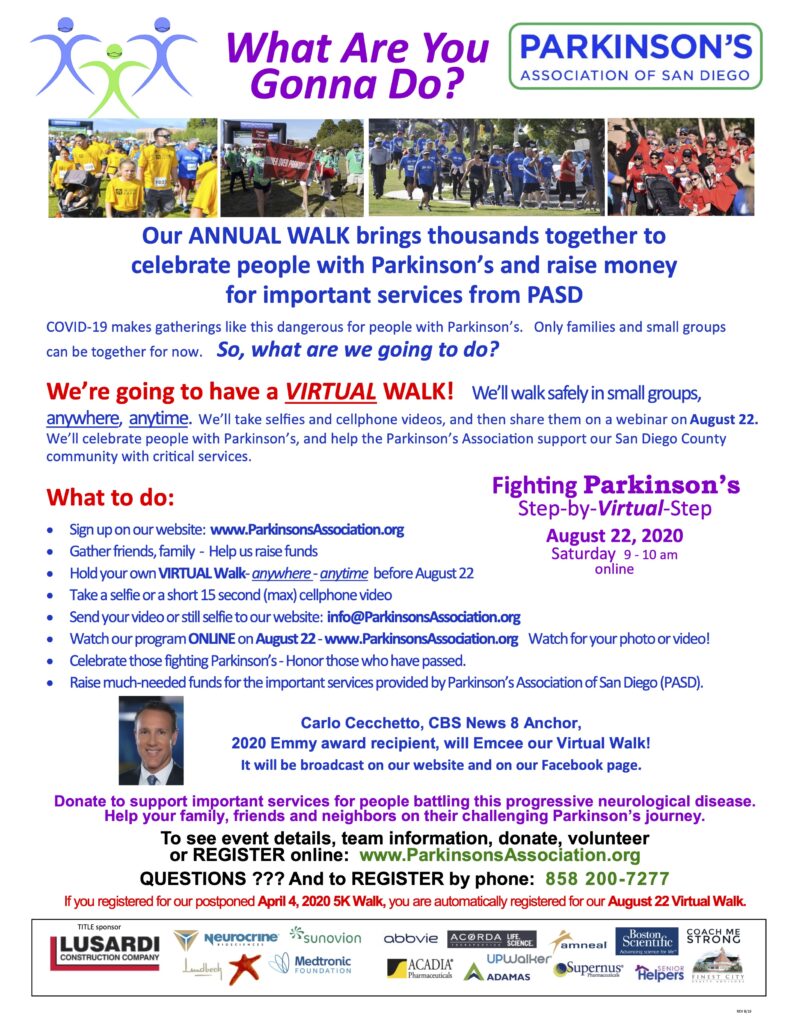

2024 Step-By-Step

NEW VIDEO COMING SOON

Next Parkinson’s Empowerment Day

December 4, 2024

A fun day of learning, sharing and empowering yourself and each other.

The 2024 Golf Tournament

June 10, 2024

Scroll up or

Thank You To Our Sponsors and Partners